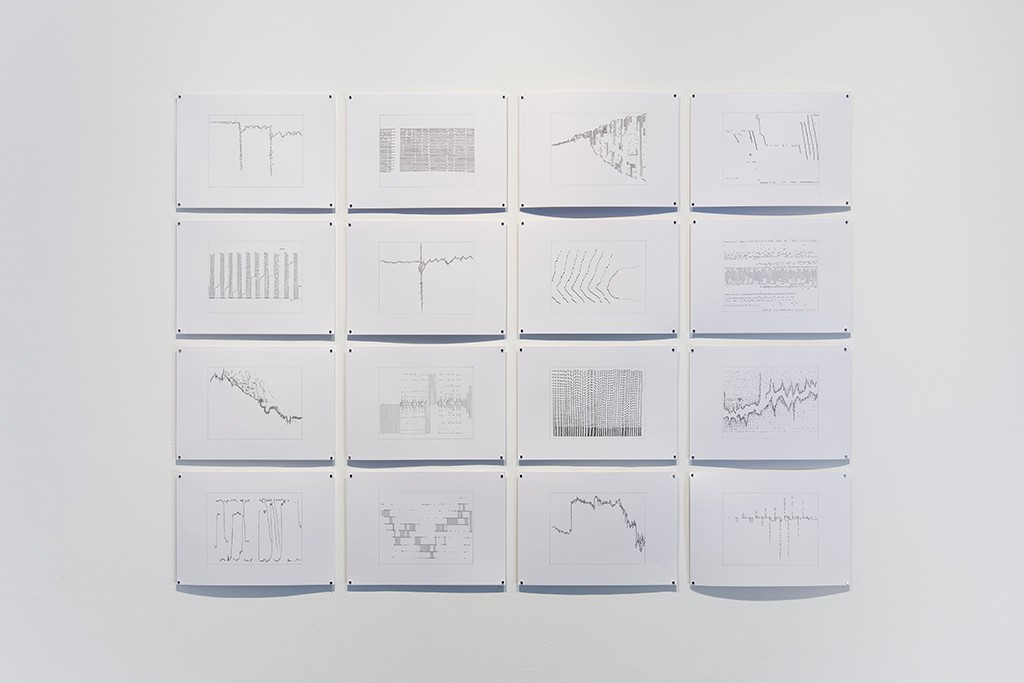

A timeframe of one second is a lifetime of trading I, Femke Herregraven (2013)

A timeframe of one second is a lifetime of trading I, Femke Herregraven (2013)

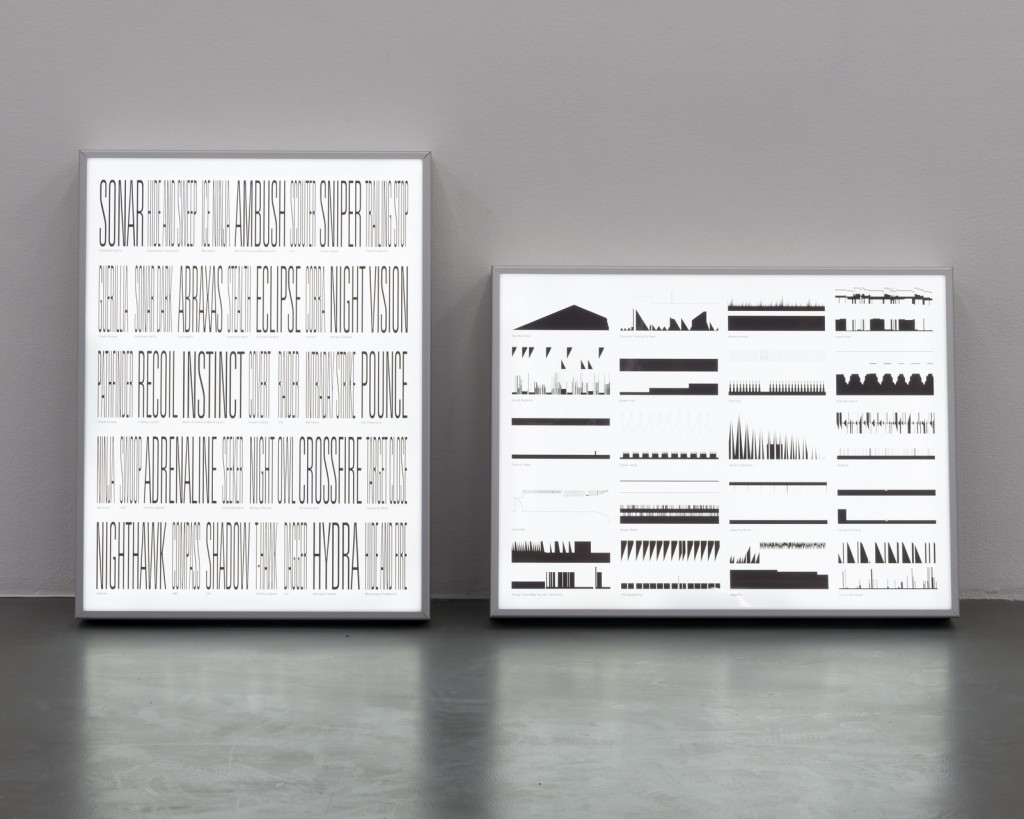

A timeframe of one second is a lifetime of trading II, Femke Herregraven (2015)

A timeframe of one second is a lifetime of trading II, Femke Herregraven (2015)

Although financial crises have historically been considered as economic crises, it is clear with the financial crisis of 2008 that they are also crises that affect our understanding of time. Trading in fixed present value has been replaced with speculation in future possible values. Therefore, a financial crisis is also a temporal crisis.

There are three crucial elements in the development of the temporal crisis – one political, one historical, and one technological. The historical element encompasses the dissolution of the Bretton Woods system and the end of it in 1971, which suspended the dollar’s convertibility into gold, to which it had previously been locked. This means that investors can speculate in value that is no longer tied up in a physical form.

The political element is most clearly observed in the neoliberal deregulation of the welfare state, a practice based on an economic thinking promoted by Richard Nixon's adviser Milton Friedman and economist Friedrich Hayek. The great idea is that a small state and a less regulated market create greater economic freedom and happiness for the individual, and, by doing so, for the society as well.

And finally, a technological element that includes the development of new financial tools: super-fast computer algorithms, telecommunications, and derivatives. Together, the three tools have enabled a trade that goes faster than the human conception of time.

At first glance, the new technologies have little to do with design. Yet, contemporary design, especially the speculative design with a focus on designing brands and future solutions, offers a unique opportunity to understand the temporal crisis that we currently sense, but do not see.

To understand the temporal crisis that modern financial crises produce, we must understand what the new technologies are and what they do. We must look into the so-called derivatives:

The derivative contract shows the germ of the temporal crisis, as it is a trade in securities between two investors, which is based on the debt security of a third party, e.g. a mortgage. The price of the derivative depends on the expected return of the underlying asset in the form of future interests. One could say that the third party provides the physical security, as the mortgage is tied to a house, and this means low risk for the investors, who themselves give security to the banks through the expected return on the third party's future interests.

This circulation may continue: the third party takes out a mortgage, the banks issue the securities and sell them to investors as derivatives, with which they speculate in the possible future value of the securities. The derivative contracts are negotiated through super-fast computer algorithms at a pace so inflated that humans themselves cannot grasp what is happening.

When three parties are present in a trade, one must understand that the investor and the bank are not trading with a physical value. The investors use the derivatives as means to create profitable transactions for both the bank and the investor through contracts on the future interest value of the underlying asset, to which the third-party debt certificate is linked. One could say that derivative contracts are the condition that renders speculation possible.

With derivative finance we see a transition from trading in fixed value to speculation in possible value. The most common derivatives go by names such as futures, options, forwards, and swaps; names that also indicate that something is shifted to the future.

In 2008, the key derivatives were the so-called mortgage-backed securities (MBS). These MBS’s are built by portfolios of debt securities from mortgage loans that are issued by private banks and resold to private investment funds. The private debt securities are issued with a higher interest rate than the previous pricing, so the banks can make more money. Thus, the MBS is a financially based product with a better profit rate than the loans offered by the state, which makes them more lucrative for investors – they simply provide higher profits with lower risks.

To further enhance the understanding of these abstract financial concepts, we need to visualize what they are and what they do. And this is where the visual arts and design come to our rescue.

In the works, A Timeframe of a Second is a Lifetime of Trading I and II, the Dutch artist and designer, Femke Herregraven, addresses exactly the technological aspect of derivative finance and the temporal crisis that it provokes.

The first work is a series of 16 drawings, where Herregraven shows the fluctuations, curves, and graphs from the computer screen, when the super-fast computer algorithms and protocols are trading with one another at a pace that people cannot perceive with the naked eye.

She shows, in other words, what derivative speculation looks like and illustrates that which is not possible with the humanly limited conception of time.

Herregraven's works are a reflection on what happens in the technological trading in derivatives in a single human second. In A Timeframe of One Second Is a Lifetime of Trading I and II, she shows that the trade we see on the computer screen does not take place in human contemporaneity, but in a mechanical circuit with its own temporality and speed. In this way, we only experience the trading in the human world, when the complex transactions have already been carried through. This means that the trade has lasted for eternities in the mechanical circuit, when humans perceive it in our time. And if one takes a closer look at the design of the aforementioned drawings, Herregraven also shows how the possible future we calculate with, is constantly changed and redesigned in the mechanical circuit. She illustrates how the derivatives use a "cut and dice"-technique, a term she borrows from the Indian-American anthropologist Arjun Appadurai – i.e. a technique that splits up certain items in a debt security in order to put them back together in a new portfolio, creating a new and better debt security.

By means of complicated mathematical calculations, the derivatives are constantly creating new and better debt securities that have a better value or score than the previous one. That creates optimal conditions for speculating in future value, instead of the value a debt security has here and now. Therefore, what the derivatives do, is designing values to speculate in future value – a financial design.

The financial designs of the derivatives accentuate the temporal crisis that financial crises produce, but they also reflect that one is dealing with a mechanical understanding of time that is not contemporaneous with the human one. In this connection, Herregraven highlights how a time-related paradox arises: Partly, a change from a focus on the present to the future, but even more important, that the future we expect is also constantly shifted and changed, so that we never arrive in time in the mechanical circuit.

With Herregraven's visualizations we can see, how investors can be said to speculate rather than trade through the derivative contracts. By means of complicated mathematical models, they speculate in the possible value of third-party debt securities, and this speculation creates a crisis in human understanding of time.

Through her works, Herregraven shows what the financial design of derivatives looks like in the fast and high-tech trading. A trade we can only measure when it has occurred, and the future has been shifted in the mechanical circuit.

But Herregraven also presents a critical view on financial trade. She shows what it looks like on the digital screen (picture 2) when a crisis enters the financial system. The viewer sees how the fluctuations on the graph go to the very top, almost like seismographic measurements when an earthquake occurs. Hence, her conceptual design becomes at the same time specific and a metaphor for earthquakes or inflation that we do not discover, until it is too late. She draws our attention to the fact that the future we think we can measure, only can be analyzed by humans once the damage is done.

And in A Timeframe of a Second Is a Lifetime of Trading II she goes one step further. Here, the viewer encounters an illuminated box with the names of several financial algorithms (picture 3). Names like Sniper, Ninja, and Hydra indicate that the financial designs are created to wage a kind of financial war with one another.

Through thorough research, conceptual design, and simple installation techniques, Herregraven makes the financial design of the derivatives visible. She shows the mechanical eternities as human seconds that no one has a chance to regulate, and which create the temporal crisis.

And with a focus on the fluctuations of the crises and the names of the algorithms, she presents a critical view on the high-speed trading with derivatives that takes place in the mechanical circuit – it is not used to help ordinary people, but to accumulate capital for the investors through (metaphorical) disasters and war.

Herregraven’s approach to derivative finance goes through new design concepts. In his essay Design and Crime from 2002, the American art historian Hal Foster has argued that design has become “subject-less”. A closer look into Fosters work reveals that he is talking about inflation in design. It is no longer about the objects being designed, but rather the brands or concepts being designed. He calls it "running room". Foster's analysis indicates that the "utilitarian object" has become art throughout the design history. We no longer distinguish between highly aesthetic art and utilitarian design or applied art, and with an increasing focus on concepts, know-how and knowledge production, we have reached a point where branding is the key. This entails designing concepts or brands for the future. Although Foster argues that brands are alone to be designed today, we can see that a branch within the design world, the speculative design, has chosen to expand the application of conceptual design. In Anthony Dunne and Fiona Raby’s Speculative Everything, the conceptual design concept is explained as follows:

The design concepts can, so to speak, be catalysts for understanding the future by materializing possible future scenarios or pointing out essential problems, as Herregraven does it in her works. Materialization and critique, therefore, become the mantra of the speculative design, as materialization opens up for a critique of the possible future. One can consider Herregraven's works as a crystallization of the speculative design that makes us wiser on two points regarding the derivative finance. First, like Herregraven, we can, through design and art, materialize the high-speed trading that humans cannot discover in the present, but only perceive after it has been realized. In this way, she visualizes the temporal crisis – the shift from the present and human contemporaneity to mechanical time and future. Second, we can critically look at what happens in the financial design of the derivative; what happens when our future is shifted and what happens when it is calculated from qualified estimates. In other words, it enables us to focus on other possible solutions for the future.

Herregraven's works serve both as an example of materialization, but also as a way of processing the fixation on the future, which is the basis for the financial crises. She forces us to think of new ways and forms of acting against the derivative finance.

The speculative design and the financial design are closely related, as they deal with future possibilities. This common denominator is absolutely essential. Where financial design is about accumulating speculative, future value, the essence of speculative design is to materialize and find solutions to future challenges. Herregraven's works clarify how the speculative design can be used as a tool or a key to understand the new temporal crisis. Not only because they conceptually show the temporality of the derivative speculation, but also because the design of the works shows what it looks like in a complete physical form. A trivial point, perhaps, but nonetheless important. Because by visualizing the mechanical temporality of the financial world, we can also much more easily translate its structures and shape them to our own advantage.

And maybe the solution is not yet there. But creating space for other possible futures also gives hope that the future is not completely lost; that it is open rather than shifted ahead or sealed off.

(1) href="https://economictimes.indiatimes.com/definition/derivatives

Selvom finansielle kriser historisk set er blevet betragtet som økonomiske kriser, så står det med finanskrisen i 2008 klart, at de også er kriser, der påvirker vores tidsforståelse. Handel i fast nutidig værdi er skiftet ud med spekulation i fremtidige mulige værdier. En finanskrise er derfor også en tidslig krise.

Der er tre afgørende momenter i den tidslige krises udvikling – et politisk, et historisk og et teknologisk. Det historiske moment omfatter afviklingen af Bretton Woods-systemet, der med sin endelige ophævelse i 1971 løsrev pengenes værdi fra guldpriserne, som de hidtil havde været fastlåst til. Det betyder, at investorer kan spekulere i værdi, som ikke længere er bundet i en fysisk form.

Det politiske moment ses tydeligst i den neoliberalistiske deregulering af velfærdsstaten, en praksis baseret på en økonomisk tænkning promoveret af Richard Nixons rådgiver Milton Friedman og økonomen Friedrich Hayek. Kongstanken er, at en lille stat og et mindre reguleret marked skaber større økonomisk frihed og lykke for det enkelte menneske og derved også for samfundet.

Og endelig et teknologisk moment, der omfatter udviklingen af nye finansielle værktøjer: superhurtige computeralgoritmer, telekommunikationsudstyr og derivater. De tre værktøjer har tilsammen muliggjort en handel, der går hurtigere end den menneskelige tidsopfattelse.

Umiddelbart har de nye teknologiske værktøjer ikke meget med design at gøre. Men det samtidige designbegreb, især det spekulative design med fokus på at designe brands og fremtidsløsninger, tilbyder en unik mulighed for at åbne for en forståelse af den tidslige krise, vi i øjeblikket fornemmer, men ikke kan se.

For at forstå den tidslige krise, som moderne finanskriser producerer, må vi forstå, hvad de nye teknologiske værktøjer er. Og i endnu højere grad, hvad de gør. Vi må se på, hvad de såkaldte derivater er:

“A derivative is a contract between two parties which derives its value/price from an

underlying asset. The most common types of derivatives are futures, options, forwards

and swaps.”(1)

I den derivative kontrakt ses kimen til den tidslige krise, idet den er en handel mellem to investorer med værdipapirer, som bygger på en tredjeparts gældbevis, der er knyttet til et aktiv – fx et boliglån. Prisen på derivatet afhænger af det underliggende aktivs forventede afkast i form af fremtidige renter. Man kan sige, at tredjeparten stiller den fysiske sikkerhed, hvilket giver lav risiko for investorerne, der selv stiller sikkerhed til bankerne gennem det forventede afkast af tredjepartens fremtidige renter.

Denne cirkulation kan blive ved med at fortsætte: Tredjeparten optager et lån, bankerne udsteder gældsbeviserne og sælger dem til investorer som derivater, de kan bruge til at spekulere i gældsbevisernes mulige værdi i fremtiden. De derivative kontrakter bliver forhandlet gennem superhurtige computeralgoritmer og foregår i et tempo, der er så opskruet, at mennesket selv ikke kan nå at opfatte, hvad der sker.

Når der er tre parter til stede i en handel, må man forstå, at investor og bank ikke handler med en fysisk værdi. Investorerne bruger derivaterne som et værktøj fra den finansielle værktøjskasse til at skabe profitable transaktioner for både bank og investor gennem kontrakter på fremtidig renteværdi af det underliggende aktiv, som tredjepartens gældbevis er knyttet til. Man kan sige, at derivaterne er mulighedsbetingelsen for spekulationen.

Med den derivative finans ser vi således en overgang fra handel i fast værdi til spekulation i mulig værdi. De mest udbredte derivater går under navne som futures, options, forwards og swaps; navne der ligeledes indikerer, at man forskyder noget til fremtiden.

I 2008 var de såkaldte mortgage-backed securities (MBS) centrale derivater. Disse MBS’er bygges op af porteføljer af gældsbeviser fra bl.a. boliglån, der udstedes af private banker og sælges videre til investeringsfonde. De private gældsbeviser udstedes med en højere rente end den tidligere prissætning, da bankerne på den måde kan tjene flere penge. Således er MBS’en et finansielt baseret produkt med bedre profitrate end de lån, staten udbyder, hvilket gør dem mere lukrative for investorer – de giver simpelthen mere profit med færre risici.

For at åbne yderligere op for en forståelse af disse abstrakte finansielle koncepter må vi billedliggøre, hvad de er, og hvad de gør. Og det er her, den visuelle kunst og design kan komme os til undsætning.

I værkerne A Timeframe of a Second is a Lifetime of Trading I og II adresserer den hollandske kunstner og designer, Femke Herregraven, netop det teknologiske aspekt af den derivative finans og den tidslige krise, som den fremprovokerer.

Første værk er en serie på 16 tegninger, hvor Herregraven har tegnet udsving, kurver og grafer fra computerskærmen, når de superhurtige computeralgoritmer og protokoller handler imellem hinanden i et tempo, mennesker ikke kan opfatte med det blotte øje.

Hun viser, med andre ord, hvordan den derivative spekulation ser ud og anskueliggør det, vores menneskeligt begrænsede tidsopfattelse ikke kan.

Herregravens værker er en refleksion over, hvad der sker i den teknologiske handel med derivater i et enkelt menneskeligt sekund. I A Timeframe of One Second Is a Lifetime of Trading I og II viser hun, at den handel vi ser på computerskærmen, ikke foregår i menneskets nutidighed, men i et maskinelt kredsløb med sin egen tidslighed og hastighed. På den måde kan vi først erfare handlen i den menneskelige verden, når den allerede er afviklet. Det betyder, at handlen har varet i evigheder i det maskinelle kredsløb, når mennesket opfatter den i vores tid. Og hvis man kigger nærmere på designet af de førnævnte tegninger, så viser Herregraven også, hvordan den mulige fremtid, vi kalkulerer med, konstant ændres og gendesignes i det maskinelle kredsløb. Hun billedliggør, hvordan derivaterne bruger en ”cut and dice”-teknik, et udtryk hun låner fra den indisk-amerikanske antropolog Arjun Appadurai – dvs. en teknik, der opsplitter bestemte poster i et gældsbevis for at klistre dem sammen i en ny portefølje til et nyt og bedre gældsbevis. Ved hjælp af komplicerede matematiske beregninger skaber derivaterne altså hele tiden nye og bedre gældbeviser, der har bedre en værdi eller score end det forrige. Det skaber optimale betingelser for at spekulere i fremtidig værdi, i stedet for den værdi et gældsbevis har her og nu. Hvad derivaterne derfor gør, er, at de designer værdier til at spekulere i fremtidig værdi. Et finansielt design.

Derivaternes finansielle design accentuerer den tidslige krise, som finanskriser producerer, men de afspejler også, at man har at gøre med en maskinel tidsforståelse, som ikke er samtidig med den menneskelige. Der er tale om en forskydning, som er ekstemporær – altså ude af tid.

Herregraven fremhæver i den forbindelse, hvordan et tidsligt paradoks opstår: Dels et skift fra fokus på nutid til fremtid, men særligt at den fremtid, vi regner med, konstant forskydes og forandres, således at vi aldrig når frem til tiden i det maskinelle kredsløb.

Med Herregravens synliggørelse kan vi se, hvordan investorerne gennem derivaterne kan siges at spekulere frem for at handle. Ved hjælp af komplicerede matematiske modeller spekulerer de i og med den mulige værdi af tredjepartens gældsbeviser, og det er denne spekulation, som skaber en krise i menneskets tidsforståelse.

Med sine værker visualiserer Herregraven, hvordan derivaternes finansielle design ser ud i den hurtige og højteknologiske handel. En handel, vi kun kan måle, når den er indtruffet, og fremtiden allerede er blevet forskudt i det maskinelle kredsløb.

Men gennem sine værker præsenterer Herregraven også en kritisk vinkel på den finansielle handel. Hun viser, hvordan det ser ud på den digitale skærm (billede 2), når en krise indtræder i det finansielle system. Beskueren ser, hvordan udsvingene på grafen ryger helt i top, nærmest lig en seismografisk måling når et jordskælv indtræder. Herregravens konceptuelle design bliver her på én og samme tid konkret og en metafor for jordskælv eller inflation, som vi først erfarer, når det er for sent. Hun gør os opmærksomme på, at den fremtid vi tror, vi kan måle, først kan analyseres af mennesker, når skaden er sket.

Og i A Timeframe of a Second Is a Lifetime of Trading II går hun skridtet videre. Her møder beskueren en oplyst boks med navnene på flere finansielle algoritmer (billede 3). Navne som Sniper, Ninja og Hydra vidner om, at de finansielle designs er kreeret til at føre en slags finansiel krig med hinanden.

Gennem grundig research, konceptuelt design og simple installatoriske greb synliggør Herregraven derivaternes finansielle design. Hun viser de maskinelle evigheder som menneskelige sekunder, man ikke har nogen chance for at regulere, og som skaber den tidslige krise.

Og med fokus på krisernes udsving og algoritmernes navne rettes et kritisk blik på den derivative højhastighedshandel, der foregår i det maskinelle kredsløb – den er ikke sat i verden for at hjælpe almindelige mennesker, men for at akkumulere kapital til investorerne gennem (metaforiske) katastrofer og krige.

Tilgangen, som Herregraven anvender til den derivative finansverden, går gennem nyere designbegreber. Den amerikanske kunsthistoriker Hal Foster har i sit essay Design and Crime fra 2002 argumenteret for, hvordan design er blevet ”subjektløst”. Nærlæser man Foster, kan man se, at han taler om en inflation i design. Det handler ikke længere om de objekter, der designes, men om de brands eller koncepter, der designes. Han kalder det for ”running room”. Fosters analyse peger på, at det ”nyttige objekt” op gennem designhistorien er blevet til kunst. Vi skelner altså ikke længere mellem højæstetisk kunst og utilitaristisk design eller brugskunst, derimod er vi med et stigende fokus på koncepter, knowhow og vidensproduktion nået til et sted, hvor branding nu er det centrale. Det betyder, at man designer koncepter eller brands til fremtiden. Selvom Foster argumenterer for, at man kun designer brands nu, kan vi se, at en gren af designverdenen, det spekulative design, har valgt at udvide anvendelsen af det konceptuelle design.

I Anthony Dunne og Fiona Rabys Speculative Everything forklares det konceptuelle designbegreb på følgende måde:

“Once we accept that conceptual design is more than a style option, corporate propaganda, or designer self-promotion, what uses can it take on? There are many possibilities socially engaged design for raising awareness; satire and critique; inspiration, reflection, highbrow entertainment; aesthetic explorations; speculation about possible futures; and as a catalyst for change.”

Koncepterne kan så at sige være katalysatorer for at forstå fremtiden ved at materialisere mulige fremtidsscenarier eller pege på essentielle problemer, som Herregraven gør det i sine værker. Materialisering og kritik bliver derfor det spekulative designs mantra, idet materialiseringen åbner for en kritik af den mulige fremtid.

Man kan betragte Herregravens værker som en krystallisering af det spekulative design, der gør os klogere på to punkter af den derivative finansverden. For det første kan vi, som Herregraven, gennem design og kunst materialisere de højhastighedshandler, som mennesker ikke kan erfare i nuet, men kun opfatte efter de er sket. Hun visualiserer altså den tidslige krise – skredet fra nutid og menneskelig samtid til maskinel tid og fremtid. For det andet kan vi rette et kritisk blik på, hvad der sker i derivatets finansielle design; hvad der sker, når vores fremtid forskydes, og hvad der sker, når den bliver beregnet ud fra nogle kvalificerede skøn. Med andre ord kan det gøre os i stand til at fokusere på andre mulige løsninger til fremtiden.

Herregravens værker tjener både som eksempel på materialisering, men ligeledes som en måde hvorpå man kan bearbejde den fremtidsfiksering, der er grundlaget for de finansielle kriser. Hun tvinger os med et greb til at tænke på nye måder og former, vi kan agere med mod den derivative finans.

Det spekulative design og det finansielle design er nært beslægtede, idet de beskæftiger sig med fremtidige muligheder. Denne fællesnævner er helt essentiel. Hvor det finansielle design handler om akkumulering af spekulativ, fremtidig værdi, er det spekulative designs essens at materialisere og finde løsninger til fremtidige udfordringer. Herregravens værker tydeliggør, hvordan det spekulative design kan bruges som et værktøj eller en nøgle til at forstå den nye tidslige krise. Ikke blot, fordi de konceptuelt viser tidsligheden i den derivative spekulation, men også fordi værkernes design viser, hvordan den i en helt fysisk form ser ud. En banal pointe måske, men dermed ikke mindre vigtig. For ved at visualisere den maskinelle tidslighed i finansverdenen kan vi også langt nemmere omsætte dens strukturer og forme den til vores egen fordel.

Og måske er løsningen her ikke endnu. Men at skabe rum for andre mulige fremtider giver også en forhåbning om, at fremtiden ikke er helt tabt; at den er åben frem for forskudt eller lukket.

(1) https://economictimes.indiatimes.com/definition/derivatives